Xem thêm

oto buyt hoat hinh

Oto hoat hinh xin giới thiệu loạt phim hoạt hình hấp dẫn cho trẻ em Việt Nam được các nhà sản xuất phim truyền hình Hàn Quốc, Nhật Bản sản xuất. Loạt...

slide mở đầu bài thuyết trình

Làm sao để thiết kế được slide mở đầu ấn tượng và thu hút nhất? Hãy cùng tìm hiểu cách tạo slide mở đầu powerpoint ấn tượng, thu hút

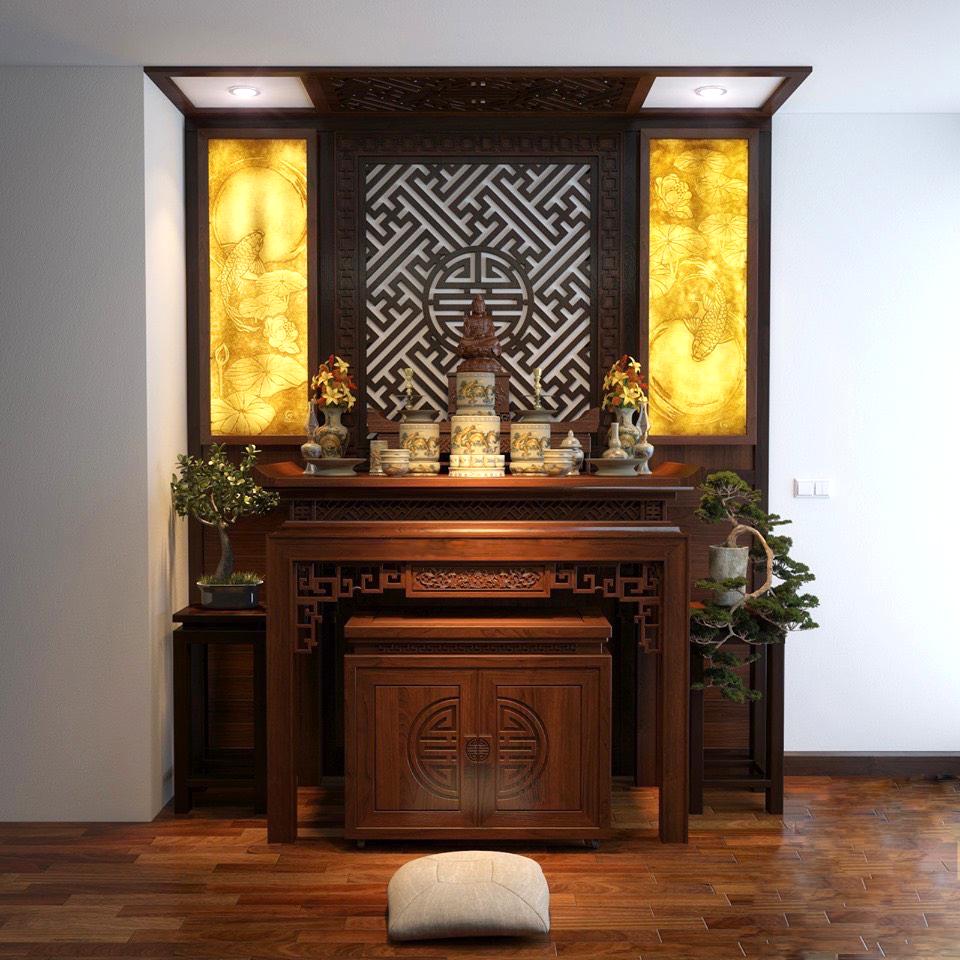

tải hình nền phật về máy

Việt Nam - đất nước mang nhiều ảnh hưởng của nền văn hóa Phật Giáo, chính vì thế mà bạn đừng nên bỏ qua Top 60+ hình nền ảnh phật đẹp...

bánh sinh nhật tặng mẹ

Mẫu bánh sinh nhật tặng mẹ ý nghĩa, hiếu thảo ở TPHCM tặng sinh nhật mẹ đpj

câu nói hay về ý chí nghị lực

Tham khảo ngay với Thiều Hoa TOP 111+ Câu nói hay về ý chí nghị lực, giúp bạn vươn lên trong cuộc sống!

cách vẽ xe buýt

Topic Description

ảnh tết 2023 đẹp

Tải ngay bộ hình nền Tết 2023 đẹp nhất, hình nền Tết Quý Mão dễ thương nhất, chất lượng full HD, 4K cho điện thoại và máy tính...

hinh anh ma da

Discover videos related to hình ảnh ma da on TikTok.

tranh phong cảnh mùa hè

Tranh phong cảnh mùa hè được nhiều người dùng lựa chọn để trang trí cho không gian nhà ở. Xem ngay 10 mẫu tranh phong cảnh mùa hè.

súc tích hay xúc tích

Xúc tích hay Súc tích, từ nào mới đúng chỉnh tả? Chúng tôi sẽ giải đáp trong bài viết sau đây để giúp bạn sử dụng từ đúng

Copyright © 2023 All Rights Reserved.